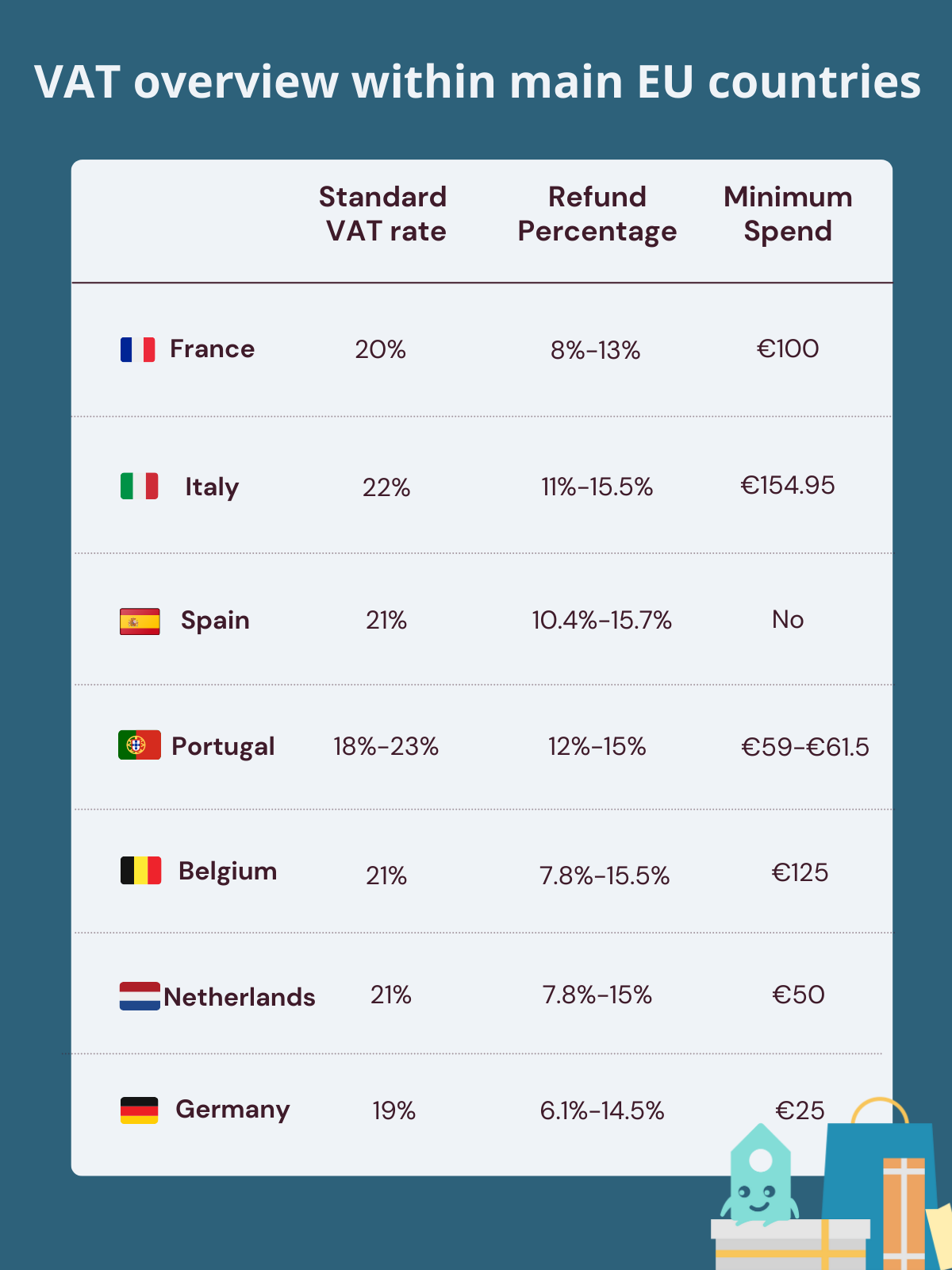

Tax free shopping: Why buying items overseas without tourist VAT refunds can lead to 'double taxation' - CNA

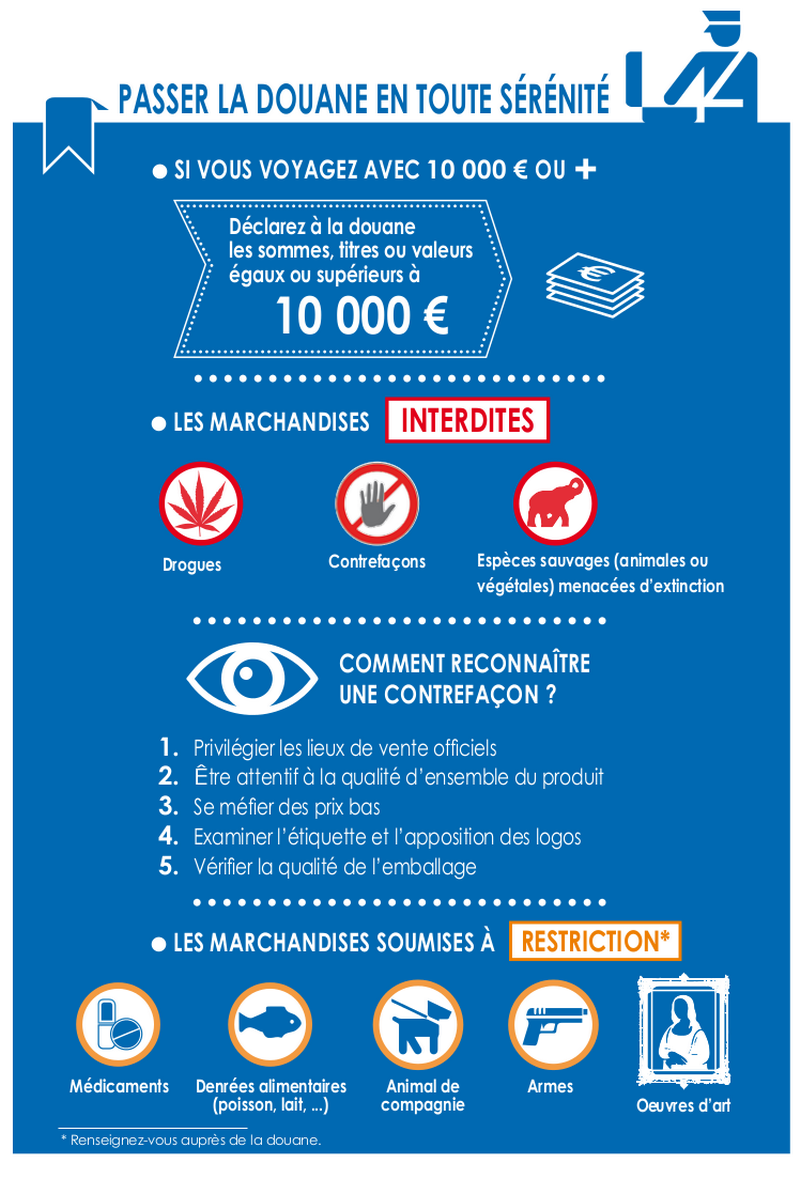

Do you pay customs duties on your purchases when you return from a trip (EU and foreigner)? | Service-Public.fr

New 10pc tax: What Malaysians need to know when buying products online below RM500 from overseas | Malay Mail

Asia News Network on X: "In a move aimed at encouraging demand for local products, Malaysia began imposing a new 10 per cent low-value goods tax from Jan 1, 2024, on items