The Value of Debt: How to Manage Both Sides of a Balance Sheet to Maximize Wealth: Anderson: 9781118758618: Amazon.com: Books

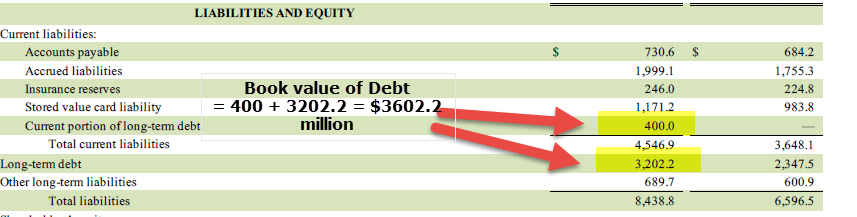

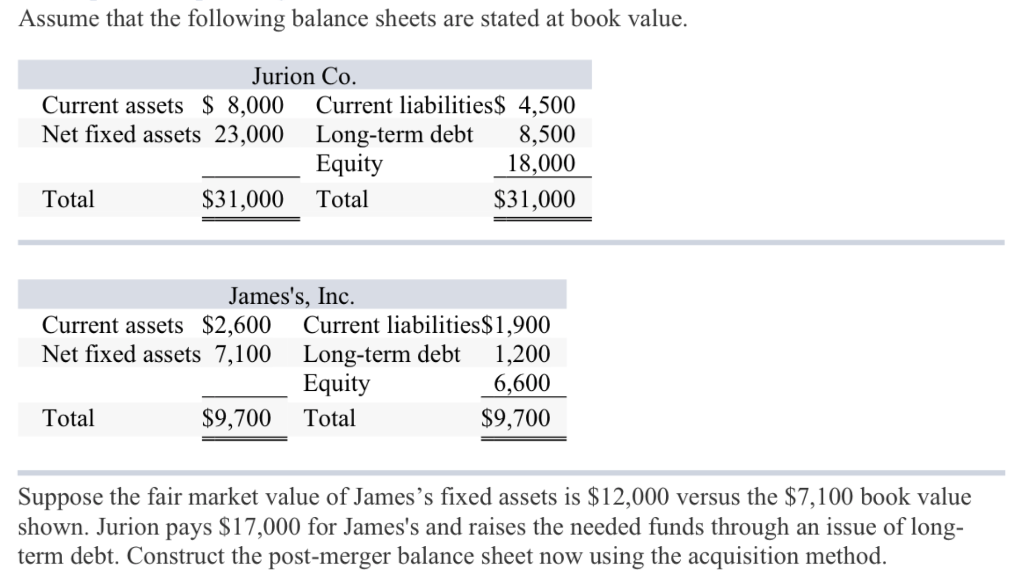

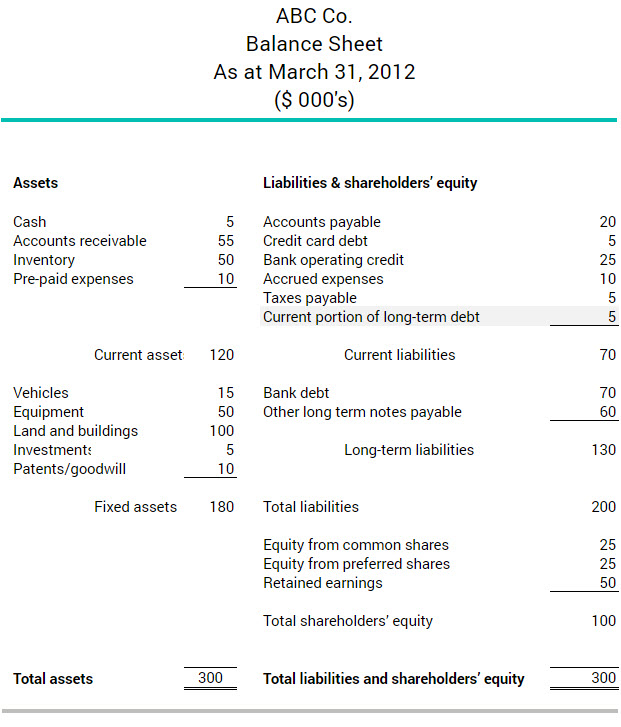

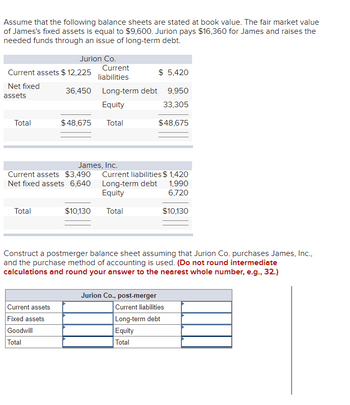

Solved! Market Value Capital Structure Suppose the Schoof Company has this book value balance sheet: $20,000,000 $10,000,000 30,000,000 1,000,000 39,000,000 $100,000,000 Current assets $30,000,000 Current liabilities Notes payable Long-term debt

:max_bytes(150000):strip_icc()/price-to-book-ratio-bf64b6abed4d4d2292f3ab58bd55ed36.png)

:max_bytes(150000):strip_icc()/book-value-99796d4d1fb44bd4bdc961e6042698d7.jpg)